The quick takeaway

- China pulled back from buying US soybeans after new tariffs, cutting demand for American farmers.

- Brazil filled the gap with bigger harvests, better logistics, and aggressive pricing.

- US growers face lower cash prices, wider basis, and storage pressure; Brazil enjoys strong margins and expansion.

- Short term, Brazil looks set to hold the export crown. Long term, currency moves, weather, and policy could shift the balance again.

How we got here

For years, American farmers leaned on China as their most important soybean buyer. When tariffs rose, Chinese crushers cut US purchases and turned to Brazil. That single switch hit the US farm belt hard. Cash prices sagged, basis widened in interior states, and storage filled up right as harvest rolled in.

Meanwhile, Brazil had exactly what buyers needed: a huge crop, competitive prices helped by a weak real at times, and improving export routes from the Cerrado to northern ports. Brazil stepped in, shipped fast, and confirmed its role as the world’s soybean superpower.

Winners and losers

United States: squeezed margins

With fewer Chinese orders, US soybeans need to find other homes. Some volumes move to Europe, Mexico, and Southeast Asia, but those markets do not replace China’s scale. Elevators respond with tougher bids. Farmers feel it through weaker basis and long lines at storage. Government relief helps cash flow, but it does not restore lost demand.

Crush plants in the US offer a small bright spot. Domestic demand for soybean meal and oil helps, and renewable diesel keeps interest in soy oil alive. Still, the net impact for many growers is lower revenue per acre than they planned heading into planting.

Brazil: expansion mode

Brazil benefited from timing and scale. Producers harvested a big crop just as buyers looked for alternatives. New rail links and northern ports cut freight costs. Strong export premiums, plus steady Chinese demand, kept cash flowing. Farmers invested in more storage, bigger equipment, and land improvements. Many are planning to maintain high soybean area next season, assuming weather cooperates.

What is driving prices now

- China’s crushers: Feed demand and crush margins guide their buying. When margins are tight, they favor cheaper, nearby supplies. Right now, that is often Brazil.

- Currency: A stronger US dollar and a weaker Brazilian real can tilt trade toward Brazil by making shipments cheaper in dollar terms.

- Freight and logistics: Brazil’s improved rail and port capacity reduces delays and demurrage, which matters when crushers face narrow margins.

- Weather: US yields and Brazil’s planting rains still set the ceiling and floor for global prices each season.

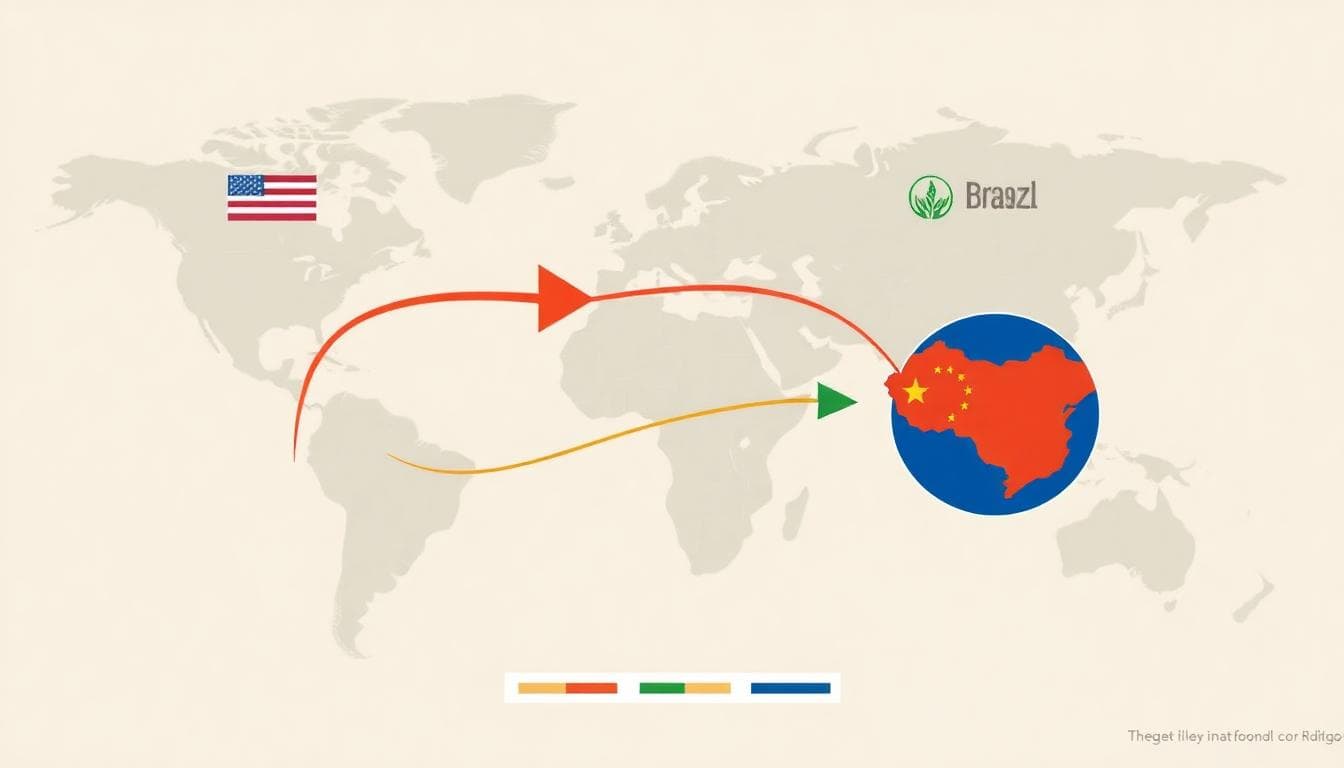

Trade flows in one picture

Think of global soy trade like a set of pipes. When tariffs or politics clamp one pipe, the flow reroutes. The US pipe to China narrowed, and the Brazil-to-China pipe widened. That shift influences basis levels across the Midwest and boosts premiums at Brazilian ports.

What US farmers can do next

- Focus on basis: Track local bids and seasonal patterns. Sometimes a nearby ethanol or crush plant offers better net returns than a distant river terminal.

- Consider storage strategy: Use on-farm bins to time sales around export windows and post-harvest rallies, if carry covers costs.

- Lock inputs early: Volatile fertilizer and fuel markets can crush margins. Lock favorable prices when you see them.

- Diversify markets: Work with merchandisers targeting Mexico, the EU, and Southeast Asia. Smaller sales can add up.

- Hedge more precisely: Use futures and options to protect downside, then sell into basis strength when it appears.

What could flip the script

- Policy changes: If tariffs ease, Chinese buyers could return for US cargoes, even if only seasonally.

- Weather shocks: A dry Brazilian season or a US weather scare can swing premiums fast.

- Currency shifts: A weaker dollar makes US exports more competitive; a stronger real can slow Brazil’s sales pace.

- Crush capacity: New crush plants in the US can absorb more beans, tightening basis locally.

Brazil’s to-do list to stay ahead

- Keep improving logistics: Finish key rail links and expand northern port capacity to reduce bottlenecks.

- Manage sustainability: Buyers are watching deforestation metrics. Strong traceability keeps premiums flowing.

- Invest in storage: On-farm storage cushions price dips and supports better timing for exports.

- Balance rotation: Protect soil health with corn and cover crops to maintain yield gains.

Right now, Brazil is winning the soybean export race. China’s pullback from US supplies, plus Brazil’s large harvests and better logistics, pushed more trade south. US growers face tighter margins until demand returns or domestic crush expands enough to soak up supply.

Markets, however, are never fixed. Weather, policy, and currency can swing momentum in a single season. Smart marketing, better storage plans, and disciplined hedging can help US farmers ride out the slump. For Brazil, the goal is to keep costs low, shipments fast, and sustainability strong to hold on to new buyers.

To contact us click Here .